SENIOR HOUSING AND ASSISTED LIVING INVESTORS

The most important question to ask when considering investing in seniors housing and assisted living in 2024 is:

“What are the current and projected demographic trends, and how do they align with the current and future location and services of the seniors housing and assisted living facilities?”

This question is crucial because demographic trends, particularly the aging population and their specific needs, are the primary drivers of demand in the seniors housing and assisted living sector. Understanding these trends can help you assess whether there will be a growing demand for these services in the areas where you are considering investing. It also informs the types of services and amenities that will be most in demand, which can significantly impact the success of your investment.

Other important factors to consider include the economic stability of the area, the competition and market saturation, the quality and reputation of the facility, and the regulatory environment, which can all impact the profitability and sustainability of your investment. Reach out to us. We are here to help.

Interesting Facts:

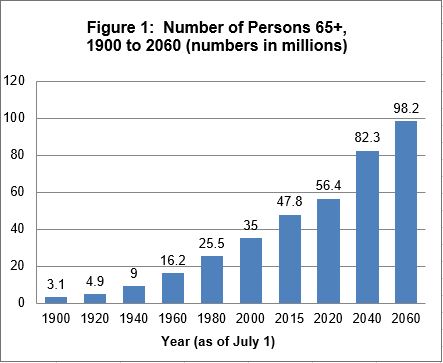

- The demand for senior housing is growing. The baby boomer generation is now entering retirement age, and this is driving demand for senior housing. The U.S. Census Bureau projects that the number of people aged 65 and older will increase from 46.2 million in 2010 to 88.5 million in 2050. This represents a growth rate of 92%.

- Senior housing is a recession-resistant investment. During economic downturns, people often choose to downsize their homes and move into senior housing. This is because senior housing can provide a more affordable and convenient option for seniors who are no longer able to live independently.

- Senior housing is a needs-based investment. The demand for senior housing is not dependent on economic conditions. Seniors will always need housing, regardless of the state of the economy. This makes senior housing a more stable investment than other types of real estate.

- The returns on senior housing investments can be attractive. The returns on senior housing investments can be attractive, especially in the long term. According to a 2019 report by the National Investment Center for Seniors Housing & Care, the average annual return on senior housing investments over the past 10 years was 11.4%.

SENIOR HOUSING IS OUR BUSINESS

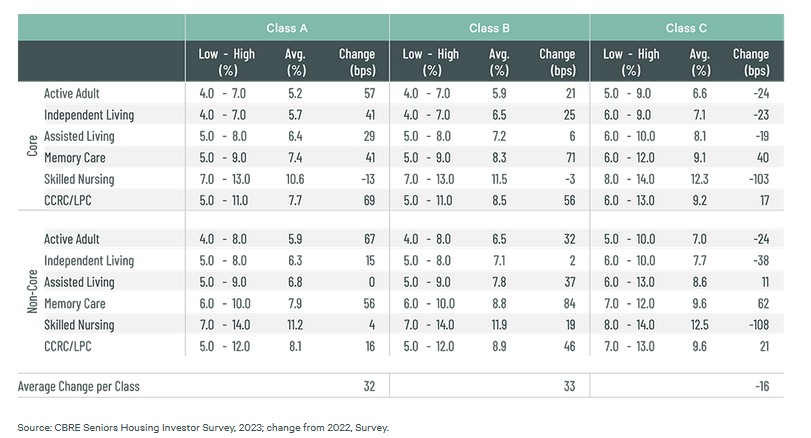

Senior Housing Capitalization Rates 2023

State of the Senior Housing Industry

Welcome to the thriving world of the senior housing industry! As a senior care investor, you have the incredible advantage of riding the wave of a massive demographic groundswell. The growth in the senior population is truly overwhelming, and the best part is that the new supply growth in the senior housing market has remained well below the peaks seen in 2006 and early 2008. On top of that, stabilized occupancy rates have been consistently on the rise.

At Haven Senior Investments (HSI), we firmly believe that from 2023-2040 the acquisition, renovation, and development of senior housing and assisted living facilities present one of the most exceptional risk-adjusted opportunities in both commercial real estate and general domestic investment. It’s an industry that holds immense potential for those who are willing to take an active and passive investment role. Please be aware that it stands apart from more conventional forms of real estate due to its unique operational complexity and rigorous regulatory requirements.

As we look ahead, we anticipate a surge of new entrants into the senior housing market. However, success in this field requires more than just being part of the crowd. It demands an experienced and dedicated investment team that can navigate the intricacies of this specialized sector.

With HSI, you’ll find that team—a group of seasoned professionals who have the knowledge, experience, and dedication to drive your senior housing investments to new heights. We understand the significance of the favorable population momentum that underpins the senior living sector, and we’re here to guide you towards success.

WHERE ARE SENIOR HOUSING INVESTMENTS HEADED?

The senior housing and care sector is generating buzz, with more real estate investors hopping on board. According to the PwC’s Emerging Trends in Real Estate 2022 Report, investing in senior housing is, once again, one of the best bets for real estate investment and development for years to come. According to the survey, investors are now more interested in independent living units, assisted living facilities, nursing homes, and long-term care facilities. These senior housing real estate properties present profitable investment opportunities for investors in 2022.

In 2021, there were 10.5 million Americans aged 82 and older; by 2025, that is projected to grow to 12 million, and by 2030 to 15 million, according to the U.S. Census Bureau.

SENIORS HOUSING AS AN INVESTMENT

Over the last five years, annual investment volume in specialty properties has accounted for 12% of all CRE investments, representing about $59 billion in annual transactions.

These are the eight main specialty investment sectors, listed by market share of all alternative investments and the annual average investment volume from 2014 to mid-year 2019:

- Seniors housing and care – 31.3% share of all alternative investments / $17.2B annual average transaction volume

- Medical office – 22.1% / $12.2B

- Student housing – 13.3% / $7.3B

- Life sciences – 11.8% / $6.5B

- Self-storage – 9.0% / $5.0B

- Manufactured housing communities – 6.3% / $3.5B

- 55+/Active adult communities – 3.2% / $1.7B

- Data centers – 3.1% / $1.7B

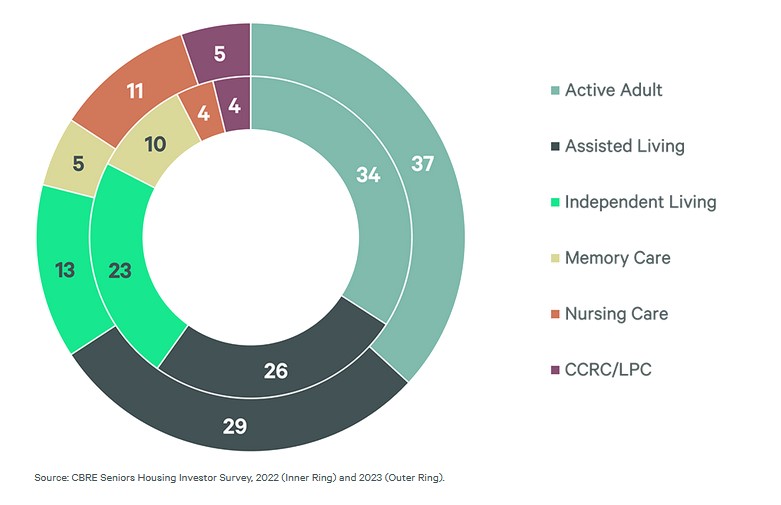

Biggest Opportunity for Senior Housing Investment (%) 2023

Be aware that with the increase in interest rates in 2023 the capitalization rate for Active Adult is below borrowing costs. That may change in 2024. Capitalization rates for Assisted Living, Memory Care, and Skilled Nursing facilities that are transacting are above the cost of debt today.

The Bottom Line

Whether you’re looking for ways to diversify your investment portfolio or you’re just getting started with real estate investing in the coming year, consider investing in senior housing. There will always be demand for senior real estate properties as American Baby Boomers age and there’s room for growth and new development due to the shortage in supply. Not only that but it’s also a low-risk investment that you can always count on to yield high returns.

For a description of all senior housing loan programs please visit our Loan Programs page.

Complete a market report before you make any decisions regarding buying or developing senior housing in your chosen location.

We are always ready to discuss commercial grade senior housing and assisted living investment opportunities. Schedule some time with us by filling out the form below.

If you are looking to passively invest in senior housing opportunities or a Senior Living Real Estate Fund, please register on our Investment Portal.

INQUIRY FORM

When you need assistance, please fill in this form and within 24 hours a representative will be in touch with you. Your information is held in strict confidence and is never sold to a third party. We look forward to serving you.